We’ve all heard about how we should save our money. We know it’s something we should do, but many of us still struggle. We tend to think we have all the time in the world to start putting some money aside. But time is money. If you want to set yourself up properly down the road, then you need to start devising a strategy. Now don’t get overwhelmed. It’s a lot simpler than you would think. Let’s discuss why getting started early is so important and the steps you should take to an optimal money-saving strategy.

The Power of Saving Money Over Time

Time really is power when it comes to saving money. When you start saving money early, you ultimately get more money without having to make as much effort.

Wait, what?

It’s a little concept known as compound interest.

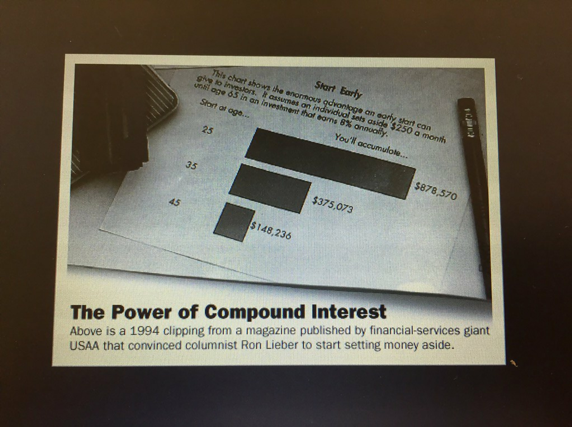

Compound interest is the amount of money you earn on your initial principal (what you save) plus the accumulated interest of previous periods. Did I lose you yet? Check out this chart from USAA. It shows you how much you’ll accumulate if you set aside $250 a month until age 65 starting at different ages, assuming a return of 8% annually.

Source: Twitter

1. If you start as a 25-year old, you’ll accumulate $878,570.

2. If you start as a 35-year old, you’ll accumulate $375,073.

3. If you start as a 45-year old, you’ll accumulate $148,236.

This is a perfect visual of how quickly your money can grow, simply by starting early.

Your Optimal Money Saving Strategy

Armed with this information, I assume you are ready to do what it takes to put a money-saving strategy in place as quickly as you can. To create your money-saving strategy you need to get real with yourself about what you need, what you want, and what sacrifices you are willing to get what you want.

Once you come up with a strategy in place, you’ll need the self-discipline to follow through. This is the key to actually being successful. Have no fear though. Even though saving money and reaching your financial goals may seem like an impossible slope to climb, with a strategy in place you will soon be on your way to making sure you have good financial health down the road. Here are six steps to help you devise your optimal money-saving strategy.

Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it. #SideHustle #CompoundInterest Share on XStep 1: Evaluate Your Situation

The first step in creating a money-saving strategy is to evaluate your situation. What does that mean? This means looking at what kind of income you have coming in every month. Make sure you include your regular stream of income as well as the income you make from all of your side hustles. Once you have an idea of how much you are bringing in, you need to look at what you are spending (and on what).

Pull out a notebook, grab your last bank statements and credit card statements and figure out where you spent all of your hard-earned cash. Make sure you make a note of each Starbucks run, pizza night, and weekend beers. Did you buy a book or an app? Be sure to note whether it was for pleasure, self-development, business, and so forth.

This is perhaps the most important step of making your money-saving strategy and you need to be honest with yourself. This step can be surprising. You’ll get to see just how much money you’ve been spending and what you’ve been spending it on.

Step 2: Make a Plan

This is the foundation of your entire strategy. This is where you will outline the purpose of establishing your money making strategy. Do you have a new side hustle that you’re just dying to get off the ground but you need the cash to get it launched? Wishing you had a rainy day fund for those just-in-case emergencies? Are you just looking to get a jump start on your retirement fund? Decide what you are saving money for, and then make your goals.

You should establish a long term goal and then a couple of short term goals. For example, you may want to set a long-term goal to save $10,000 by the end of next year and a short term goal to save $400/month for the rest of this year and a goal of saving $600/month all of next year. Just make sure the goals you set work for your situation and are attainable.

The next part of making a plan is to create a budget. Looking at the numbers you wrote down from your spending last month, create a budget with comfortable figures in each of the main categories: food, shelter, clothing, entertainment, and health. Once you have established your budget, you need to track your spending religiously and stick to it.

Step 3: Get Smart About What You Spend

This step can be a bit difficult. It’s where you’re meant to get a little uncomfortable. You need to think and analyze what you spend. Cut back on what you spend. Don’t indulge yourself just because a store has a sale. Skip the Starbucks trip and make your coffee at home. Buy a case of beer and have your friends over to your place rather than going out to the bar. Make little changes that can save you cash.

Another way to get smart about what you spend is to look at your monthly bills. Do you have subscriptions that aren’t really getting used? Ahem, cable. Consider changing your utility companies. Oftentimes when you switch companies, there is an introductory rate you can take advantage of, allowing you to save money. This is true of pretty much every kind of utility including garbage removal, telephone and internet, cable, etc.

A great tool to help you analyze your spending to find areas to optimize your spending, check out Squeeze.com. It’s a free personal finance website used to provide consumers comparison pricing on their recurring bills so that you can save money, reduce debt, and grow wealth. It’s a great site that helps consumers become more aware of their personal financials through analytics and coaching and to save money on their recurring bills through our price aggregating website.

Step 4: Protect Your Credit

It’s easy to get carried away with your money, especially when you are young. However, you need to be smart about your money and actively work to protect your credit. This means making sure your bills are paid on time, in full, and try your best to not carry credit card debt. If you currently hold credit card debt, start trying to pay it back. This doesn’t mean avoid credit cards altogether though. It just means be smart about it.

Being smart about how you use credit cards can help you build up your credit so that you have a strong credit score. This is more important than you think. A high credit score means you are eligible for better rates on car loans, mortgages, etc. Why does that matter? Well, in the long run, it will save you money as you’ll end up paying less in interest, simply because you took the pain to keep your credit score strong.

Step 5: Focus on Your Health

You need to treat your body well. That means eat right, exercise, and sleep. What does this have to do with saving money? I promise there’s a connection.

We end up spending a serious amount of money on healthcare throughout our lives between the cost of doctor’s visits, medications, diagnostics and testing, hospitalizations, etc. However, most of this could be avoided if we just took care of ourselves. So skip the bag of chips and eat an orange. Have a green smoothie in the morning before your workout. Keep your body healthy and you’ll end up saving money down the road.

Step 6: Start Saving

Start putting away what you can and watch your money grow. It doesn’t have to be a lot. Start small and slowly increase the amount you put aside each month. Sometimes this can be a challenge, especially when you are used to spending your whole paycheck. One way to make it easier is to open a savings account. Then set up an automatic withdrawal from your checking account into the savings account, scheduled for the day you get paid. This would send the money directly to your savings account with no way to spend it. Then, before you know it, you’ll have a sizeable amount in your savings.

You may also want to talk to different banks to look into other savings options such as long-term CDs with higher interest rates, etc. Talking to the bank can help you find out what all kinds of accounts they have available, the expected interest on these accounts, and the frequency with which you can withdraw. Choosing an account with a high-interest rate can get you to your goal and you can launch your side hustle even sooner than you thought.

Compound interest is the most powerful force in the universe. Compound interest is the greatest mathematical discovery of all time. #SideHustle #CompoundInterest Share on XBonus Step: Don’t Worry About Your Student Loans

Here’s a bonus step for you. There’s always a big push to pay off your student loans right away, especially when people start to talk about getting out of debt and saving money. However, it may be best for you to hit the brakes on that. Take a careful look at your loan paperwork and determine what your interest rate is. If you have a low-interest rate, it is okay to keep the student loan debt and have your money work for you. This means continuing to make your monthly payments, but don’t jump right in and pay off the whole amount. Instead, use the money that you would have used to pay off the loan to invest in something with a higher return than your loan’s interest. This can help you make money despite holding the “good” debt.

Get Started!

You’ve now got the tools you need to set yourself up properly down the road. With a little bit of effort you can see big gains in the amount of savings you have, whether your end goal is a rainy day fund, an emergency fund, retirement, or just having the extra cash you need for your next side hustle idea. All of these tips are actionable things that you can do starting today, so what are you waiting for?